How Aggregators Are Disrupting The Amazon Ecosystem

Like so much of the world right now, the Amazon ecosystem is changing.

Privately owned umbrella companies, known as aggregators, are disrupting the jungle and their impact is staggering.

Amazon sellers all over the world are being affected.

Sounds serious, right?

Well, it is.

But it might not be what you think.

The presence of these ‘new kids on the block’ could mean a $1M paycheck is on your horizon.

Read on to find out more.

Who are Amazon aggregators and what are they doing?

Amazon aggregators are currently one of the hottest segments of the start-up world.

In the last two years alone, over 89 Amazon aggregator companies have been born, across more than 20 countries, with a combined capital of over USD $12 billion (Marketplace Pulse, 2021).

Companies like Berlin-based Razor Group, Boston-based Perch and Thrasio, Paris-based Branded and London-based Heroes are just a handful of the aggregators currently raising hundreds of millions (sometimes billions!) in equity investment.

Their sole focus?

Acquiring multiple successful small-to-medium-sized Amazon brands (the kind we teach our students to grow), and using their large-scale (‘aggregated’) resources to grow, optimise and massively increase the business’s revenue.

It’s a smart strategy:

Instead of taking on all the risk of a start-up business, aggregators wait for Amazon sellers to build a successful brand, before swooping in and making their offer.

They pay for the risk, creativity, proof of product and market-fit tests to be complete and proven.

And by doing this, aggregators are taking the Amazon world by storm.

But this is not a new business model.

It’s the same strategy giants like Procter & Gamble have used for decades – buying out smaller companies then using their weight to dominate prime space in supermarkets and TV ad slots.

A tried and tested model, it’s not necessarily bad news for Amazon entrepreneurs.

Aggregators are providing sellers with the option to exit their businesses with a (sometimes pretty major!) profit.

What’s more, rather than trying to replace or market the businesses they acquire as their own, aggregators often maintain the original brand name, as well as their customer base.

As a seller, this is great news.

It means all the time and effort spent building your brand isn’t lost.

Aggregators see brands and their customers as assets and use their culminated resources (including software that streamlines manual processes, such as monitoring listings and competitors) to grow and optimise the businesses they acquire.

All Snoop Doggs Go To Heaven

A prime example of an Amazon aggregator in action is with the pet odour control product – Angry Orange.

Purchased by one of the world’s largest aggregators, Thrasio, in 2018 for USD $1.4m, its annual revenue at the time was just over USD $2M.

Within two years, having revamped the branding and marketing (including an endorsement from Snoop Dogg), Angry Orange is now the fastest growing pet product on Amazon and generated over USD $16.5 in 2020 alone.

That’s a HUGE increase in revenue.

But let’s dig into the REAL money.

We’ll assume, prior to being purchased by Thrasio, that Angry Orange operated at a 20% profit margin…

So, annual revenue = $2M

20% profit = $400k

This means Thrasio purchased Angry Orange at a price-earnings ratio of 3.2X their annual profit (3.2 x 400 = $1.2M).

Now let’s make another assumption:

Let’s assume that in 2020, when Angry Orange was run by Thrasio and generated $16.5M, that they were running at a 25% profit (this is VERY conservative and would likely be much higher).

16.5M x 25% = $4.125M annual profit (compared to the $400k it was originally).

Now lets multiply that annual profit by 3.2X (Angry Orange’s original price-earnings ratio) = $4.125 x 3.2 = $13.2M.

The math is undeniable.

Thrasio took an already successful medium-sized Amazon business and increased its profit margin, in under 24 months, by 10X.

And that’s just ONE example of the impact an aggregator can make.

Thrasio owns over 120 brands just like Angry Orange.

They employ more than 900 people in the US alone and have raised over USD $1.75B in capital since its inception in 2018.

Thrasio is a powerhouse.

But there are other Amazon aggregator companies just like it.

Companies looking for the chance to get venture capitalists involved in the smaller individual Amazon seller world.

And the growth of the online retail industry in the last two years provided them with the perfect opportunity…

The Perfect Storm That Makes You Rich!?

We all know what the Covid-19 pandemic has meant for the online retail world.

A sector that was already growing, eCommerce BOOMED in 2020 and 2021.

Amazon is at the heart of it.

The scale of Amazon’s growth, combined with customers’ continued hunger for online shopping, created the perfect environment for Amazon aggregators to thrive.

As new brands with consumer interest are launched every day, there is no limit to aggregators’ ability to find and acquire companies (Crunchbase, Nov 2021).

This simple reality means it’s a seller’s market right now.

In fact, profitable Amazon businesses are in such high demand some aggregators are spending thousands on gifts to woo potential sellers.

They’re offering everything from boxes of cigars, to invites to exclusive parties – and in one case, FREE TESLAS for referrals (CNBC, 2021).

How crazy is that?!

People are out there receiving $60k+ cars for FREE, just for referring Amazon sellers to aggregators.

They’re not even the ones with the business to sell, and they’re being rewarded!

Amazon is the pie, and everyone wants a piece of it.

And aggregators are pulling out all the stops to make sure they capitalise now.

Their hunger for acquiring new businesses is only more evident when considering the experiences of our own students recently…

$10M For Reliable Students In 90 Days

In just the last 90 days alone a handful of Reliable Education students have received more than $10M collectively from Amazon aggregators.

This group of students did the hard work, built their businesses and have been able to cash out on their own accord.

It’s an INCREDIBLE achievement for these students – and something that’s only been made possible with the expansion of the aggregator market.

They’ve created a new world of opportunity within the Amazon ecosystem.

Age or prior experience are irrelevant.

And students just like you, are hitting millionaire status because of it.

Take Sam, for example.

First pitching his business idea at one of our Summit events in 2018, he was only 12 when he began his Amazon journey.

Sam saw a gap in the plastic cups market and, with the help of his parents and by following the steps of our course – started making money online and ultimately built a winning Amazon brand.

Now at just 15 years old, he made national news for selling his business to an aggregator for over $1 million.

Check out this quick 9NEWS story for the full scoop.

This aggregator recognised the value of Sam’s product and business – and in return, Sam and his family were offered a lucrative exit deal.

A deal that has changed the course of Sam’s life.

Not bad for a kid still in high school!

And then there’s Sachin.

Sachin is another Reliable Education student who recently exited his Amazon business by selling to an aggregator, Una Brands.

An immigrant with English as a second language, Sachin is a father of two young children, who began his Amazon business four years ago with nothing.

Now, he’s a millionaire who just bought his first family home.

Sachin’s commitment to building a solid brand focused on everyday items with simple differentiations, paid off.

In just four years his Amazon business (which used NO fancy advertising or PPC campaigns, NO video on the listing and NO social media posts) grew by 15 times before being snapped up by Una Brands for over 7 figures.

Sachin’s journey is an incredible one, but he’s the first to say – if he can do it, so can you.

Check out his recent Facebook post for the full story…

What Does All This Mean For YOU?

The above figures and stories have probably got you thinking…

Maybe it’s time to start your own Amazon business?

Or, if you’re already live on Amazon, maybe you’re wondering if selling is in your best interest?

And it’s true.

There’s a LOT of opportunity to make money on Amazon right now.

To cash up and cash out.

To live the life you first dreamed of when starting your business:

Free of the corporate 9-5…

Spending more time with your family and friends, doing what you love…

Without worrying about your kids’ school fees, or what your dream family holiday might cost.

Or, like Sachin, you might use selling to an aggregator as an opportunity to build the capital you need for your next business venture.

Either way, it’s worth considering your WHY. And whether your business is more about making money than a love for it.

If it’s the first – then selling might be the right decision.

But, as with any business sale, before you jump in guns blazing, you need to do your research.

Consider The Facts…

In October 2021 Fortunet (the leading investment bank in the e-commerce mergers and acquisitions market) conducted a deep dive into the investment criteria and acquisition process of 42 aggregator companies.

Fortunet wanted to dispel the myths and mystery surrounding the ‘new kids’ on the block, and educate smaller sellers about how to value, and ultimately exit, their Amazon businesses.

What they learned was surprising.

Selling for millions to an aggregator might be far more within reach than you’d think…

To Sell Or Not To Sell: 7 Things You NEED To Know About Amazon Aggregators

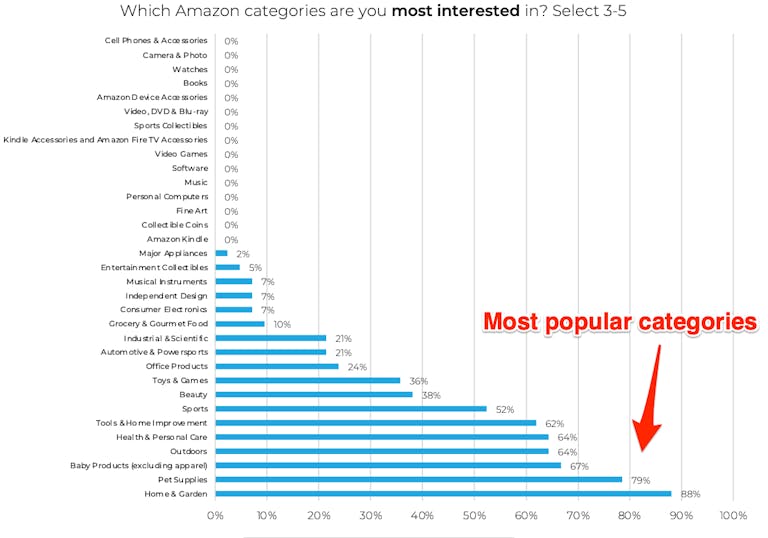

1. Aggregators LOVE evergreen products

When purchasing an FBA business, the most popular categories Amazon aggregators are interested in are Home & Garden, Pet Supplies, Baby Products, Outdoors and Health & Personal Care.

Why?

Because products in these categories are easy to supply to consumers on a long-term basis, unlike the likes of Apparel, Electronics and Supplements.

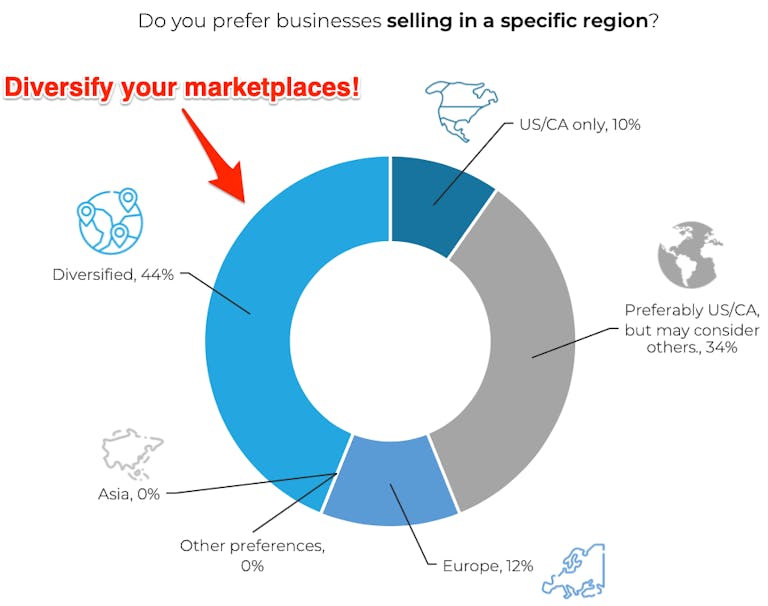

2. Diversified selling regions are preferred

44% of aggregators are looking for businesses that sell across multiple regions, with another 34% stating they prefer US and Canada but are open to others.

Given the strength of the US market, this is unsurprising, as any businesses already profitable in the US will be more easily rolled out across other marketplaces.

So, if you’re selling across multiple Amazon marketplaces – you’ve got a shoo-in!

3. Operate for at least a year

Contrary to popular belief, the majority of buyers (40%) only require a minimum operating time of ONE YEAR.

You don’t need a super established business to appeal to aggregators.

A year allows enough time for businesses to have solid proof of concept and to have acquired a good amount of listings and reviews.

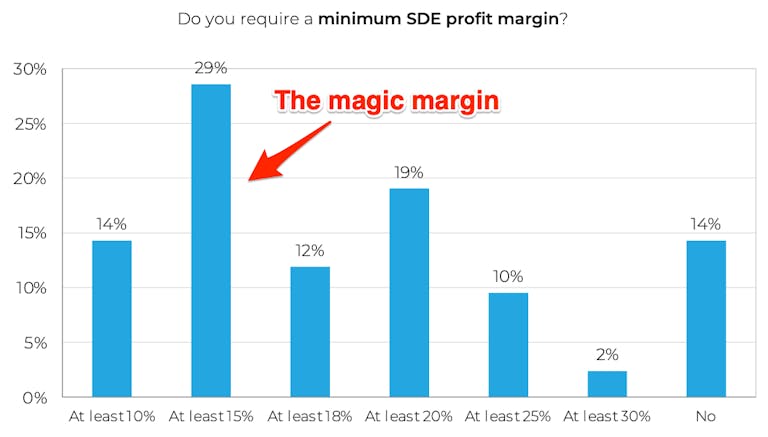

4. 15% profitability is the magic margin

If your Amazon business has an annual profit margin of 15% or higher you’re in the buying zone!

29% of survey respondents are looking for at least a 15% annual profit margin, with another 14% of surveyors only requiring 10%.

Rather than seeking only highly profitable businesses, the motivation for acquiring brands with smaller turnover is that aggregators can likely purchase them cheaper, and grow the profit margins themselves.

5. Aggregators LIKE businesses that only sell on Amazon

Approx 63% of respondents stated building a social presence or selling in brick and mortar stores won’t necessarily add value to your business in their eyes.

This says a LOT about Amazon and the benefits of focusing on the things that bring about the most return.

Rather than trying to diversify your sales platforms – focus your attention on elevating your brand on Amazon.

After all, aggregators are only interested in acquiring tried and tested brands (that’s how they make their money), so if you can prove yourself on Amazon, you’re halfway home.

Think about Angry Orange again:

- An Amazon-based brand, they had a steady business with decent returns.

- And within two years of acquiring the brand, Thrasio 10Xed their value, without expanding to other sales platforms.

- Instead, Thrasio invested their resources into improving the Angry Orange branding, listings and visibility on Amazon.

And the results speak for themselves.

So, while alternate sales channels might increase your brand’s value in the long term, for the sake of selling to an aggregator, their sole focus is generally on Amazon and the brand’s potential in that space.

6. The location of your suppliers doesn’t matter

It’s a common misconception for people to think using China-based suppliers is a risk.

It’s not.

68% of respondents confirmed where your manufacturers and suppliers are located holds no bearing over the appeal of purchasing your business, while 12% actively prefer Chinese made goods.

This finding confirms we need to get over China FUD (fear, uncertainty and doubt).

Using suppliers from China is oftentimes your best option – and could actually work in your favour when it comes to selling to an aggregator.

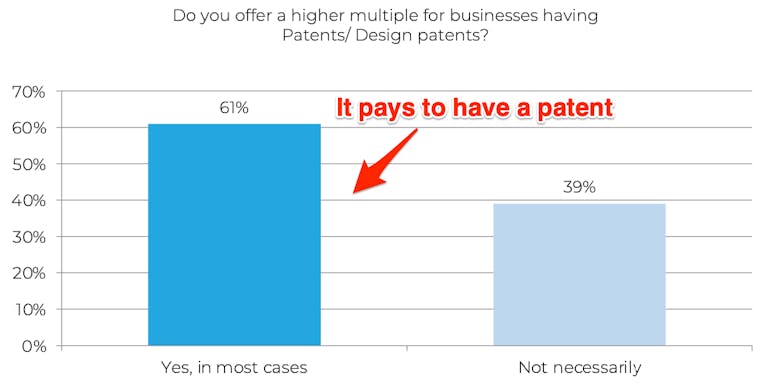

7. Having a brand/design patent PAYS

Outside of the company’s profitability, this is one of the only factors aggregators are interested in, with 61% agreeing they would pay more for a patented business/design.

We all know the importance of product differentiation on Amazon.

Your product needs to cut through the crap and grab consumers’ attention.

If an aggregator is interested in purchasing your business – there’s no doubt you’ve been successful in differentiating your product and achieving that cut-through.

Patents are key in protecting your competitive advantage, as they ensure exclusivity over your design.

It’s so important we have a whole lesson dedicated to this alone in our online Amazon course.

So it’s unsurprising businesses with patents and strong product differentiation attract higher purchase prices.

In addition to the above key takeaways – Fortunet’s survey revealed 65% of buyers will pay a minimum of $500k-$1M to acquire a brand.

More than half also confirmed they do not have a maximum purchase price, while 42.5% have a limit of $10M.

Moral of the story?

For the right business and product, aggregators are prepared to PAY.

And unlike a lot of misconceptions, Fortunet’s survey proves your Amazon business doesn’t have to be doing millions in profit to appeal to aggregators.

After only a year of successful trading, you could look to cash up and cash out – ready for your next adventure (entrepreneurial or otherwise!).

The expansion of the aggregator sector within the Amazon ecosystem means, whether you’re a current student or are looking to start an Amazon business, aggregators offer a new exit opportunity that could fast-track your path to financial freedom.

If you’re serious about selling your business, I suggest giving Fortunet’s full report a read – it’s packed with useful information.

If you’re not currently selling on Amazon, but would like to discover more about building a successful income stream online, you might like to check out my new LIVE webinar. During the webinar, I reveal the simple, proven strategy to build an Amazon business that will make you money. This strategy is how our students have generated over $1.4B USD in sales on Amazon in the last five years, and how in the last 90 days a handful of them have been able to sell to aggregators for over $10M collectively. You could be next. Register here to join my next webinar.